Impact investing is an increasingly hot topic for families and investors looking to see

both a financial return as well as delivering positive change for the environment and society. With ESG becoming mainstream, we are observing client driven trends towards creating measurable positive changes. Whilst it's encouraging to see these changes in the market, they are potentially challenging and confusing for investors to look at returns through a different lens.At Acorn Capital Advisers we advise families on how to decide which environmental and societal challenges to focus their impact on and notice the next generation having an increasingly strong voice at this table. When a family agrees on the kind of impact they want to make, this is the beginning and not the end: the implementation of an effective impact strategy requires vision, conviction and careful attention to detail.

Here we aim to demystify and help investors to understand how to create impact with

their wealth, strategically, and address some of the questions that impact investors

face on the journey to implement their goal of targeted solutions to global challenges.

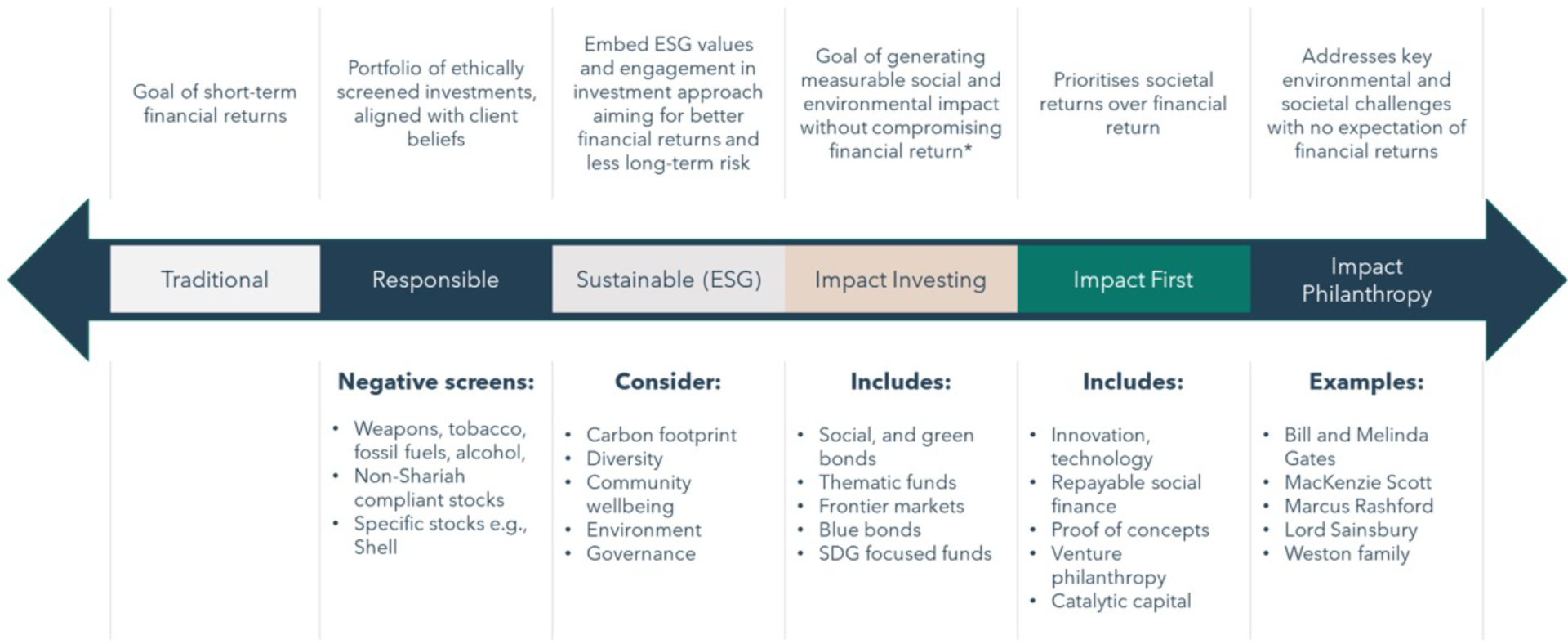

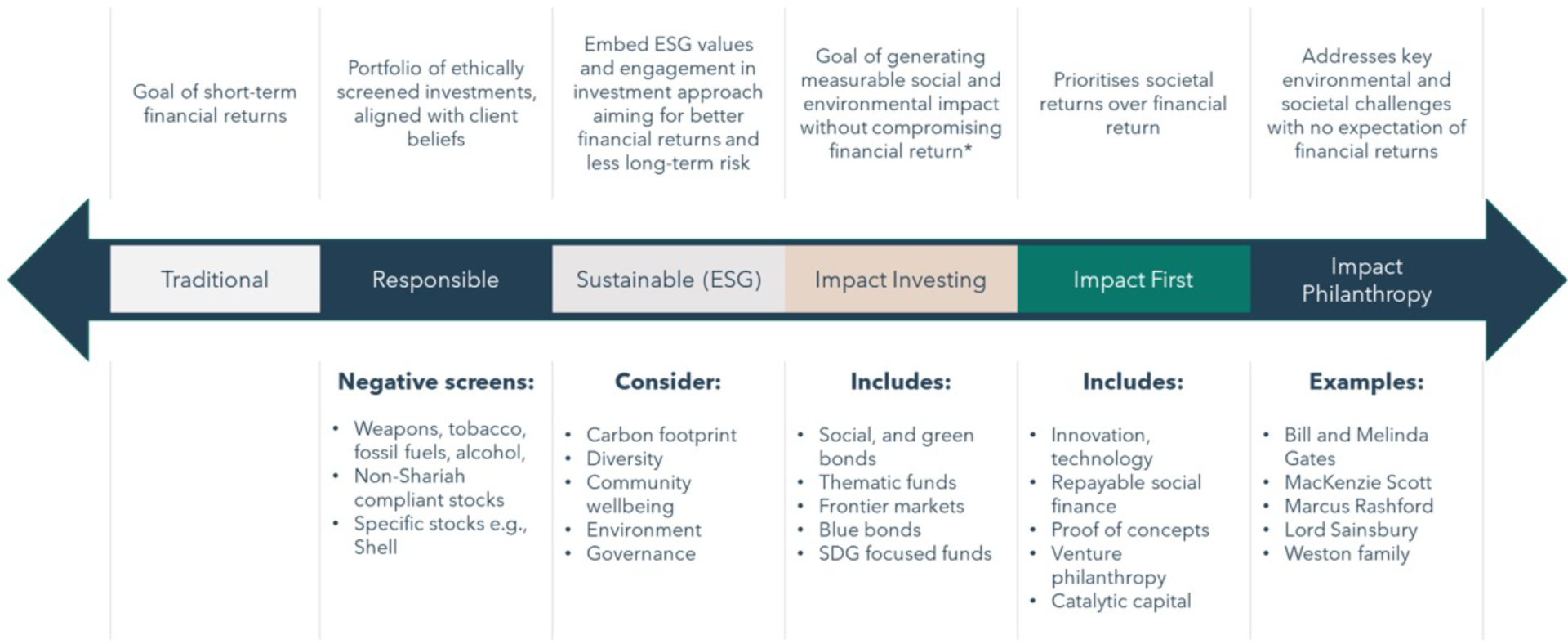

Impact investments can be found in bonds, listed equities, funds and private markets. This makes it difficult to decide whether to incorporate impact investments into existing allocations – for example adding green bonds within a bond allocation – or to dedicate a ‘sleeve’ of wealth exclusively to impact investing. As the chart below shows, there are many opportunities to create impact from investing in specifically themed funds, such as innovative healthcare solutions, through to venture philanthropy, where an early-stage investment approach can make a difference in achieving philanthropic goals.

Impact investments have become a rich and diverse set of opportunities. We believe that within a current diversified portfolio they can substitute for more traditional investments, particularly within bond, infrastructure, real estate, listed and private market assets, whilst adding a positive measurable impact to the overall portfolio. A good example is the significant capital raised through social bonds issued by the International Finance Corporation in recent years to support women and other underserved populations in low income, emerging countries to have access to finance and other basic services.

Alternatively, setting up a discrete capital ‘pot’ dedicated to impact may enable a specific mission-based vision to be executed by direct investment targeted in private market opportunities, with their longer-term focus, away from the public eye. If financial returns are not a priority, capital could be deployed very effectively to de-risk the early stages of an investment, acting as a catalyst to others to provide lower risk follow-on capital. A good example of this is the Bill Gates led Breakthrough Venture Technology, which is investing in a Massachusetts Institute of Technology developed carbon capture technology, which is currently only workable in a laboratory environment but has the potential to make a key difference to carbon sequestration globally.

Prospective impact investors also need to know who are the impact decision-takers – is it the manager running a diversified fund of impact funds or is it a manager backing their own judgement and investing directly? Whilst a diversified fund usually gives a wider reach, it can duplicate fees and complicate the measurement. Either way, the level of trust needs to be high and the due diligence on the manager, their resources, impact approach and measurement framework requires scrutiny. In this field, we respect the work of the team at Snowball on the managers they invest with, which includes assessing the degree of manager engagement, their impact risk management and the extent to which their managers are catalytic.

https://www.snowball.im/impact

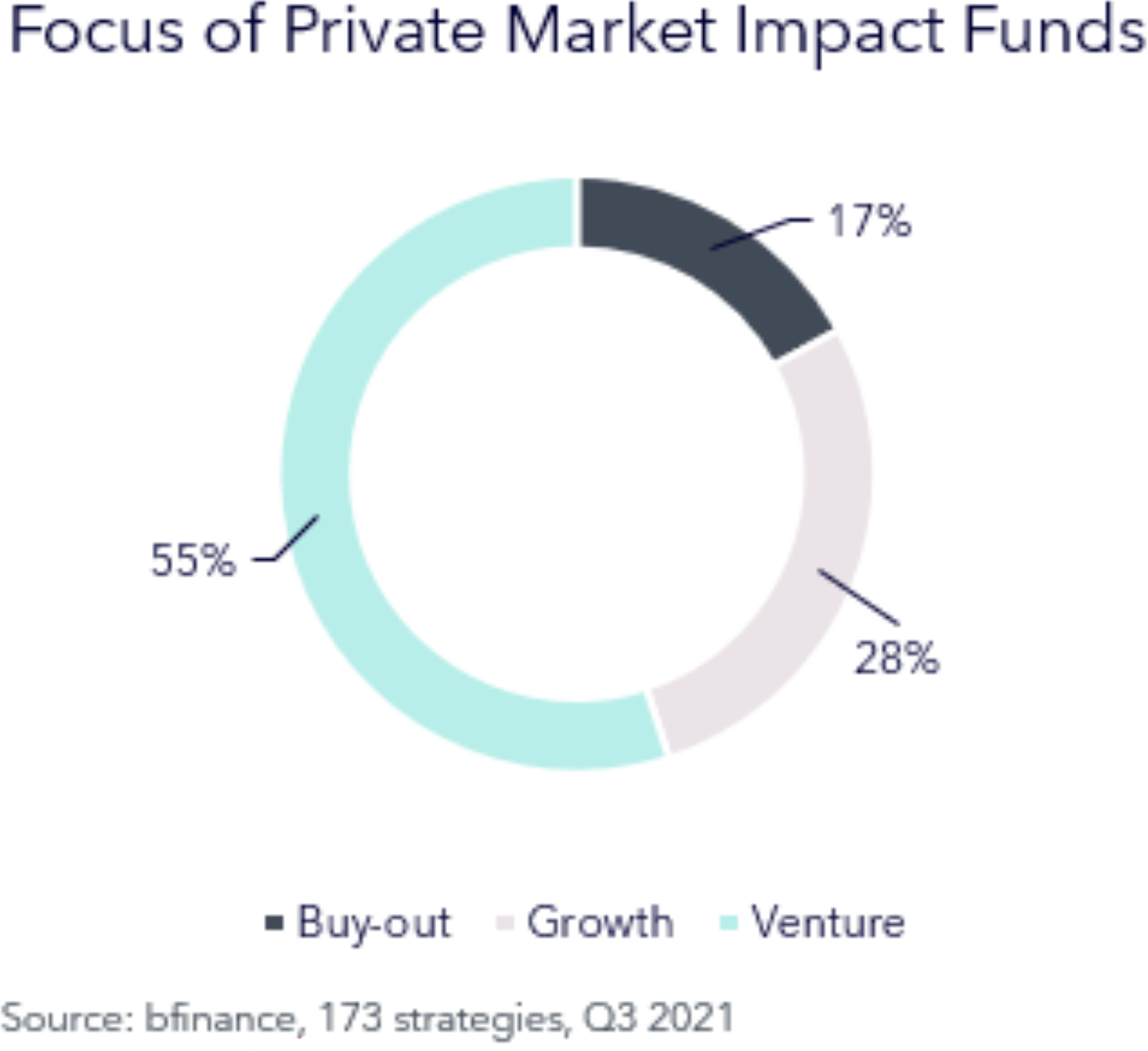

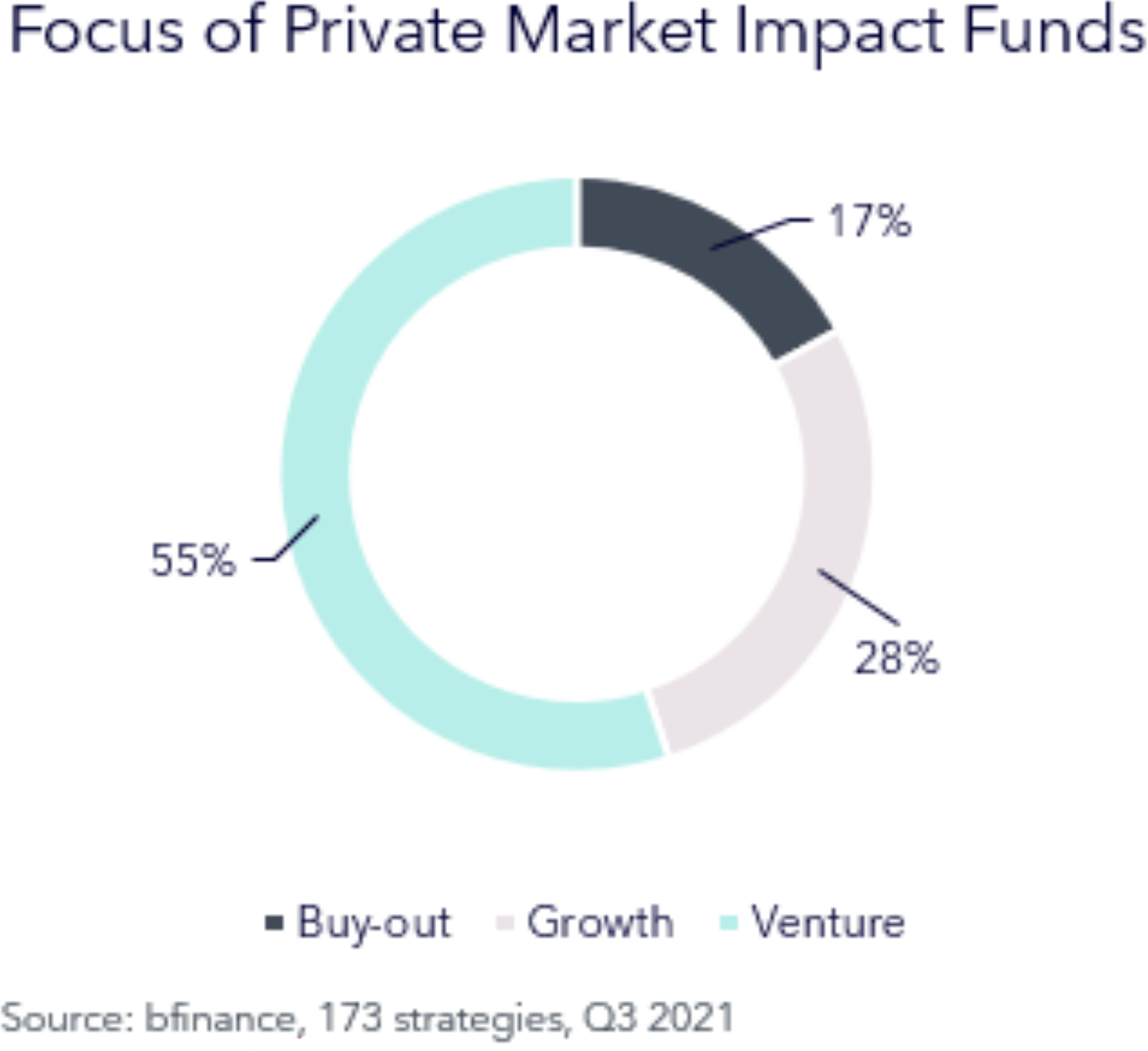

Some families ask to what extent should private markets form the core of an impact portfolio? Given the timeframe, we believe there are excellent opportunities in private markets for patient investors focused on long-term challenges, notably climate change. Also, at the earlier stage of the spectrum there are interesting opportunities to invest in venture capital through innovative, often disruptive companies embracing technological solutions. It is no surprise therefore to see that there has been a bias of private market impact funds towards venture rather than later stage growth or buy-out opportunities, as the chart of private market impact fund allocations illustrates:

We generally recommend though balancing the riskier end of the spectrum such as venture investing with asset classes with more predictable return streams such as social housing bonds, renewables or other infrastructure assets, which are often supported by public sector backed guarantees.

Whilst impact frameworks have advanced a very long way, there is often no perfect measurement solution, and this can sometimes unnerve those seeking greater mathematical clarity. By keeping a close eye on the detailed evidence-based measurement metrics and adopting a practical approach, including being alert to impact washing, the impact measurement risks can be mitigated. Impact investing involves some different risks to traditional investing besides the potential lack of data, there is impact execution risk, where the desired outcome is not achieved or alignment risks where a positive impact fails to be embedded in a long-term repeatable process.

Despite these potential pitfalls we are confident that courageous impact investors with a strong desire to make a difference will find rewarding opportunities to deploy capital. Indeed, the last twelve months have highlighted the scale of investment required to achieve net zero targets and to address social imbalances. There has never been a more appropriate time to consider impact investments.